Silver Lining | Weekly Stock Market Update | 16 Oct

6 day in 6 minutes Weekly Market Wrap-up. Catch up on all that’s trending in the last week and get ready for the Monday markets with insights from our expert research Powered by www.arihantcapital.com

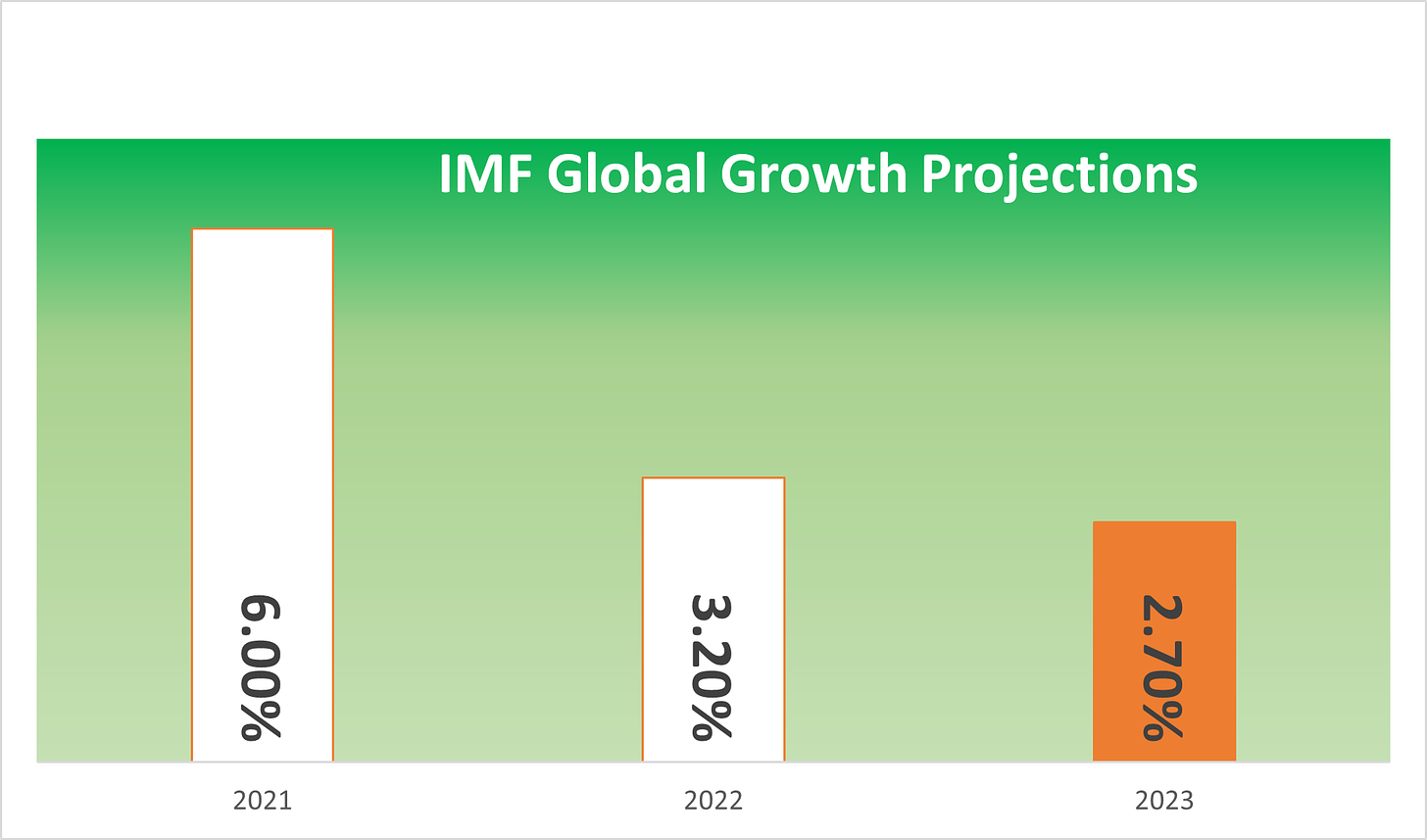

The IMF released its much-coveted World Economic Outlook, and it ain’t pretty.

The world economy is experiencing a broad-based and sharper-than-expected slowdown due to a cost of living crisis, tightening liquidity and the effects of Russia-Ukraine war and the lingering Covid-19 pandemic. Gloomier still, it believes the worst is yet to come, inflation will rise to 8.8% in 2022 coming down slightly to 6.5% by 2023. It has even reduced the growth projection of 2023 to 2.7% which is the worst since 2001. While there is some good news for India, as India is projected to be the third biggest economy behind the US and China by FY28.

Inflation woes

US inflation stood at 8.2%, which is higher than many estimates. In September, India’s consumer inflation rate spiked to a five-month high of 7.41% from 7% the month before. Although WPI inflation showed a brief respite and fell to 10.7% in September against 12.41% in August. Add to this the IIP fell 0.8% and IMF downgraded India’s growth forecast to 6.8% from 7.4%.

High prices of consumer goods are burning a hole in the common man’s pocket who is already facing the brunt of high-interest rates on loans. Let us hope the Indian government steps in to control these costs after RBI’s efforts to tame inflation have proved futile. Talking about India’s growth prospects, although IMF has reduced its growth forecast to 6.8% but our FM believes it may grow at 7% in FY23

Now lets finally get to the good news.

The Q2 result season is off to a good start, TCS, Infosys and Mindtree posted some good numbers registering strong deal wins, better pricing lower employee costs and margin growth. Although these stocks led a rally on the Street, Wipro numbers disappointed and investors punished the counter for it. There is no denying that the global turmoil will catch up to the IT growth, but till then the markets found some time to celebrate. Read on to get detailed results, stocks in news, and EV news.

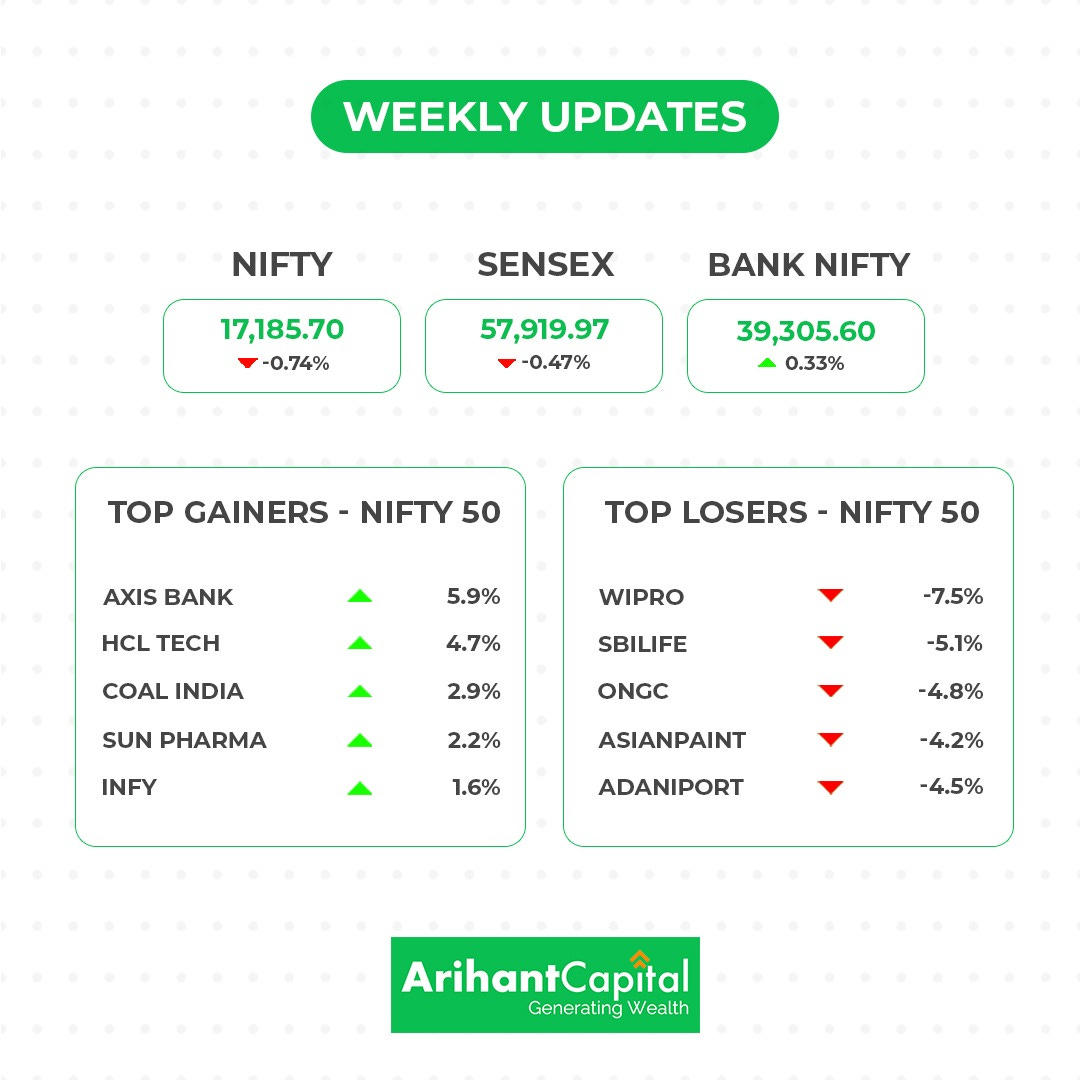

Nifty closed the week on a negative note of -0.7% at 17,186 with 129 pts loss and BSE Sensex ended the week at 57,920 muted by 0.47%. Bank Nifty gained by 0.33% during the week, ending at 39,306.

📈Market Outlook

-Mr. Ratnesh Goyal, Sr. Technical Analyst, Arihant Capital

Nifty

On the daily chart of Nifty is trading near to 200SMA an upward gap area is observed. On the weekly chart, we are observing Doji candlestick formation. We believe that the market may remain in consolidation and will face resistance at higher levels. Nifty can face resistance around 17,350 level if it starts to trade above then it can touch 17,480-17,600 levels. While on the downside support is 17,100 if it starts to trade below then it can test 17,000 and 16,800 levels.

Bank Nifty

On the daily chart of Bank Nifty, we observe Doji Candlestick pattern as well as an upward gap area. If we look at the weekly chart, prices traded near the downward gap area. We believe that Bank Nifty may outperform as compared to Nifty in the coming days. If it trades above 39,700 then it can touch 39,950 and 40,300 levels, however the downside support comes at 39,100 below that we can see 38,700-38,500 levels.

💰Stock Picks

From the technical desk

-Mrs Kavita Jain, Head Learning and Sr Research Analyst at Arihant Capital

📊What to expect from the markets

-Mr. Abhishek Jain, Head Research, Arihant Capital

India's stock market closed in a positive momentum on Friday as the decline in oil and gas, and power stocks were offset by gains in banking and information technology stocks. We continue to maintain cautious outlook on market. Some stock specific trades can be done in this market.

🔍Quick Bites

Automobile

Auto sales hit an all-time high in September with more than 3.55 lakh passenger vehicles.

Bajaj Auto buys back shares worth ₹2499.97 crore

Maruti Suzuki is driving resurgence in Japanese OEMs with its facelifts, new models and variants.

Energy and Infrastructure

Govt grants one-time compensation of ₹22,000 crores for Oil Marketing Companies (IOC, HPCL, BPCL) to battle rising LPG prices globally

India increased windfall tax on crude by ₹11,000 per tonne. Duty on ATF is now reintroduced.

Adani Port gets NCLT nod for acquisition of Gangavaram Port.

IRFC-IIFCL sign pact to finance railways infrastructure.

Power Grid Corporation of India (PGCIL) announced that it has acquired ER NER Transmission (ETL) under tariff-based competitive bidding.

Industry

Abu Dhabi Investment Authority has picked up 0.8% stake in lead producer Gravita India through open market transactions.

Tata Steel may exit UK business due to a lack of government support.

JSW Cement to invest ₹3,200 crores to set up two greenfield cement manufacturing units.

L&T bagged an order between ₹1,000 crores and ₹2,500 crores for its water and effluent treatment business.

RIL to raise up to $1.5 b and Jio eyes $2.5 b via foreign loans.

India Cements sells its entire stake in Springway Mining to JSW Cement for ₹477 crore.

Adani in talks with global investors to raise $10bn.

Other

Airtel tops in 4G download speeds, Jio tops in area coverage.

TCS launches new collaboration with Microsoft to build autonomous solutions with Project Bonsai.

Marksans Pharma doubles its manufacturing capacity by acquiring Israeli Drug maker- Teva’s pharmaceutical plant in Goa.

RIL is the only contender to acquire Metro AG’s India business

Singapore Airlines confirms talks with Tata Group on Vistara-Air India merger.

📝Key Results

Infosys showed an 11% jump in profits and a 23.4% jump in consolidated revenue to ₹36,538 crores.

Wipro reported a 9% drop in profits for the July-September quarter. However revenue rose to ₹22,540 crores.

HCL Technologies posted a 7% rise in its consolidated net profit for the September quarter at ₹ 3,489 crore. Revenue rose 19.5% YOYO to Rs 24,686 crores.

TCS earned a net profit of ₹10,431 crores an 8.4% increase on-year, exceeding analysts’ forecasts for Q2 earnings.

Mindtree Q2 profit jumps 27.5% to ₹509 crore.

L&T Infotech Q2 net profit up 23% at ₹679.8 crores

HDFC Bank Q2 profit up 20% to ₹10,606 crores boosted by retail and corporate lending.

ICICI Prudential Life net dips 55% in Q2.

Bajaj Auto Q2 profit jumps 20% on year to ₹1,530 cr, revenue rises 16%.

🔌Sustainability Corner

Suzlon Energy has secured a new order from the Aditya Birla Group for developing a 145 MW wind power project.

Coal India to set up a 1,190 MW solar power plant in Rajasthan.

Siemens and Volta Trucks partner to accelerate commercial fleet electrification.

Chinese electric car maker BYD launched Atto 3 in India.

Tata Motors launched an affordable EV car- TATA Tiago priced around ₹8.5 lakhs to attract Indian customers. It will commence its sales from January. It already received more than 10,000 booking in just 3 days of its launch.

Electric car sales in India picking up rapidly; registering 268% YoY growth to cross 18,000 units in first-half of FY2023; Tata Motors rules the market with an 85% share while MG Motor India has 8%.

Bajaj Auto targets doubling of its Chetak electric scooter sales to around 6,000 units a month by March 2023.

Ultraviolette Automotive, backed by TVS Motor Company will launch its new performance-oriented F77 e-motorcycle in November.

Mahindra launched its first EV car called XUV 300. It will commence its sales from January. The SUVs will likely be showcased in concept or near-product.

Jio BP will set up a charging network ahead of M&M’s e-SUV launches.

BPCL set up fast EV charging stations in South highways.

Uttarakhand announces subsidies for electric vehicles.

Chargeup organizes EV Mela in Delhi.

Causis E-Mobility bags an order to ply e-buses in the Kalyan-Dombivli region.

UP Government rolled out its EV new policy giving 100% exemption on registration fees and road tax for any purchase of an EV car.

Delhi Government installs 1,000 EV charging stations in less than 1 year.

Hinduja Group to invest in electric bus manufacturing in Kerala.

CESL installs first solar-powered charging station in Ladakh.

BEL sets up EV charging station at HPCL’s retail outlet on Chandigarh-Shimla Highway.

Ather Energy, electric two-wheeler manufacturer to ramp up its production.

India needs more than 20 lakh charging stations to support EVs by 2030 according to a Report.

Indian Railways to replace its vehicles with EVs by 2025.

Thats all for now folks, see you next week. BTW, did you love this edition? Want us to improve? Let us know in the comment section.